Managing director of SG Partners, Michael Lang, almost says it as an aside – but he says it often because it is a truth all business leaders instinctively know: if you don’t have sales, you don’t have a business. Yet as Mr Lang well knows – it is his business to know – effective leadership, sales training and long-term sales team building is woefully low on the budget line and list of priorities for Australian business leaders. He argues a major problem facing Australian business right now, especially in the financial services sector, is the mind-set of business leadership. Here is how Michael Lang and his SG Partners team are there to help.

By Mike Sullivan >>

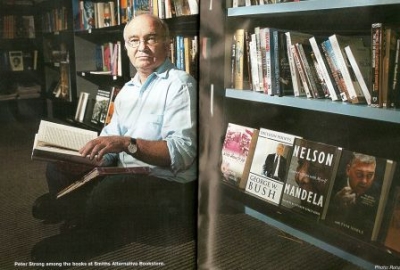

IS IT ALL in the mind? SG Partners managing director Michael Lang has a mind to say so, about Australian business success.

In fact, it is Mr Lang’s extensive observation over many years of how successful business people guide their companies, by understanding what drives their people, that led to his study of neuro linguistic programming (NLP). Now Mr Lang and his SG Partners teams apply NLP to their training courses and positive business change programs.

While Mr Lang and SG Partners started in the field of sales training, lately he has focused on chief executives, managing directors and key executive leaders – because their leadership skills and behaviours have been empowered by his programs.

Too many business leaders, he believes, have been guilty of harbouring mindsets that were limiting innovation within their own organisations. And, stifling revenue generating opportunities along the way.

Michael Lang believes great business leaders must know their own minds, know how to stimulate the mind sets of others, read the aspirations of those who work for them – and they effectively ‘mind the shop’ by placing customer service and sales at the top of everyone’s minds and agendas.

Great business leaders, often without realising it, are tapping in to the science that underpins SP Partners training programs: NLP.

“If you want to change someone’s behaviour, skills alone will not do this,” Mr Lang said. “Nor will putting them in a new environment – it will not change people’s behaviour”.

“How many times have we heard from people who come up from Melbourne to the Gold Coast and say, ‘My life sucks in Melbourne, so I’ve come up to a warmer environment’. And after a while they go, ‘Oh, the Gold Coast sucks, I’m going back to Melbourne.’?

“Because they have bought their baggage with them. The environment doesn’t change you. What changes you are your rules, or beliefs, that allow you to keep your values.

“And that is all about neuroscience. How the mind is wired, and how you change that wiring”

NLP techniques, often applied to sports people and high-performance professionals in the entertainment and military spheres, are surprisingly easy to learn for business leaders. The often difficult requirement for success is that you must change your own mindset first. This is where SG Partners comes in.

“You can change it (the mind) just by changing your language. Simple,” Mr Lang said. “It starts with changing your state.”

“If someone is in a negative state, as in their posture is closed, you find their breathing becomes shallower, therefore less oxygen goes to their head, the brain starts to shut down and creates a protective mentality,” he said. “It releases certain chemicals that allow you to be protected, but what it doesn’t do is engage the frontal lobe. The frontal lobe is where all the ideas and thinking comes from.

“That’s how we could get into a depressive state. Because by feeling down to start with, the chemicals released to keep us safe, those chemicals don’t allow the thinking of choices, so then we start to spiral and spiral and spiral.”

“By managing your state – by getting oxygen to flow – you now have your brain working at full capacity. It’s that simple.”

While Mr Lang observes sporting coaches applying NLP techniques with their players at various levels, for a business leader a much deeper understanding is required to achieve a sustained outcome”

“Highly trained sporting individuals and teams go on the field every week, but they don’t win every week. Isn’t that interesting?” he said. “Here’s the thing … they might get into peak state, but do they really understand why they are doing it? They are doing it because their coach has told them.”

“If you understood why you are doing it, then you would be able to tap into it consciously, consistently”

“We want to get into an ‘unconscious competence’. Just like when we drive … we often arrive somewhere and we go, I don’t know how I got here. That is an unconscious competence – you know how to drive so well that you don’t even think about it. You make the right choices automatically.”

“That’s why when we train people we provide them tools and strategies to implement,” Mr Lang said. “We may have the tool, but what is the strategy of using that tool? A lot of people just get the tools. That’s not good enough in business.”

LEADING BY EXAMPLE

Understanding what drives people and what their fundamental needs are, at work, underpins successful leadership, Mr Lang said.

“As a leader it is, more often than not, about giving people certainty,” Mr Lang said. “Certainty can be in many things to many people.”

“There are people who live in, ‘I need certainty’. There are people who live in ‘I need variety’. When you think about it, if you are investing eight hours a day in your job, you don’t want to be doing the same thing every day, year after year. That is why some organisations rotate their people with the task they perform when it is repetitive”

“Some people need significance. They want to be heard and they will conduct themselves in a way that will either be positive or negative.”

“You take some people consistently seen in the media. They demand significance. And they will bully people, they will go to court, they will engage the media. That is their way of saying I want acknowledgement . That’s the way they comes across. Whereas other people might say I can get my significance by tapping into the hearts of other people.” Mr Lang said.

“Then there is connection and love. People want to have connection to a tribe. We are all tribal. We want to be connected to something. Some people dwell in that space more than other spaces.”

“Then there is growth. People want to grow. We actually need to grow. “

“We also want to contribute. Most successful people in their heart, as well as their mind, want to contribute back.

“So it is about finding where you resonate both in a personal and professional environment.”

This is what business leaders must come to grips with and interpret so they can shape a successful business direction.

“Neuroscience is about understanding how our mind map is created and how what our model the world is,” Mr Lang said.

CHANGES OVER TIME

It is complicated, Mr Lang admits, but business leaders can learn the tools and strategies that make decisions around these states of mind instinctive.

“When you are a baby, you want certainty. That is your highest priority,” he said. “Be fed, that is a priority, for sure. And there is love as well, love and connection.

“Teenager. It’s variety. It’s connection to peer groups. And there is some significance. They are not into contribution so much.

“When you get older, when you are my age, 50, you want to probably say, how can I give more back? I’m doing the CEO Sleepout this year, for instance. I have wanted to that for years. I am an ambassador of Opportunity International. I jumped off a 35 story building a couple of years ago for Save the Children, and I raised some money to do that.

“But then you look at young people who do want to contribute … often it is about the environment they live in.

“So is it is an age thing or it is about something that just strikes a chord with some people?

“There are some people who just get stuck in certainty. Why do you come to work? It gives me food on the table. That’s it. Who am I to judge them?

“I love growth. I love helping and succeeding and helping others to grow. That’s just me,” Mr Lang said.

“What we want to do is get the balance right. We run professional workshops for business people – and what we know is, that if we can help them personally, it will make it easier for their professional lives to change.

“If you can change someone’s rules or beliefs, then you will get a change of behaviour.”

GETTING TO THIS POINT

Michael Lang’s journey in this area was shaped by his close observations of businesses and business leaders – some winning, some losing – over decades.

He started to assist sales teams in the mining and resources sectors, first through a period at Brisbane-based Mincom – a world leader in mining and public infrastructure management technologies that is now part of the multi-national ABB group – and then through a specially-created arm of the Australian Industry Group (Ai Group) the Mining Equipment and Services Council of Australia (MESCA).

Mr Lang focused at MESCA on helping mining supply companies to develop better sales systems, strategies and people. During his time there, he was instrumental in doubling MESCA’s membership.

“Through that time, I saw that the mining industry was changing. They were learning. The suppliers weren’t,” Mr Lang said. “Why would they? They were getting so much business, they didn’t have to do anything differently.

“So I started challenging the members and I started bringing training in. Through that, I got quite passionate about people engaging differently to get even better outcomes. So I later moved on to start the company (SG Partners) in just training.

“Then we learnt along the way that training in a workshop is not sustainable. You are just giving them a shot in the arm and the adrenalin wears off. That’s because, in a stressful environment, we will always go back to what is comfortable.

“Change only happens when we become uncomfortable. When we are consistently stretched.”

“So I studied neuro linguistic programming.”

SALES BLOCKAGE: LEADERSHIP

SG Partners found it was on a winner. The sales teams it assisted in its early days were measuring solid improvement, and SG Partners was rapidly building its business successfully through word-of-mouth based on these results.

Michael Lang, however, was not satisfied. He found while the NLP techniques were clearly effective, the sales teams were regularly encountering resistance from their management.

“We are doing all this sales improvement,” Mr Lang said. “And we are doing all these long term and short term and we were seeing change – but you know what, along the way I thought, you know, change could be even more if leadership changed their mind sets. That’s where I started getting involved more in leadership.

“Australia struggles with leadership. It not something at the forefront of our minds.”

“Look at the Americans. Americans strive and aspire to be like (significant) people. Here in Australia, don’t get too confident, I’ll cut you down.”

“What is it like to be a true leader?” Mr Lang pondered. “Ask any Australian: name me a great leader. They probably wouldn’t name an Australian. Richard Branson would come to mind. Obama. Many other people, but not many great Australians, really. Certainly our Prime Minister would not come up, because we don’t defer to his leadership. We actually take the mickey out of our politicians.”

“We don’t congratulate leadership in Australia. If we want greatness in our country, then we have to understand that we have to embrace it. Not import leadership. We have to want it.

“If we are not used to being around it, then it is a scary thing.”

TECH STARTUPS AFFECTED

Mr Lang felt this problem was playing out right now across Australia in the sphere of early-stage technology companies and ‘tech start-ups’. Venture capital and seed funding is more of a focus that sales and growth strategies.

“You start looking at the Apple’s and the Amazons and you say, okay, what type of leadership and what type of management system have you got?” Mr Lang said, remarking that these companies were adept at constant evolution.

“The trouble with start-ups is, when they look other models of leadership, they look once only. If you are emulating other start-ups, they are changing all the time. You have got to follow that journey. You have to change constantly.

“Companies will only grow when you continuously innovate: processes, systems, products, people and the way to engage with the marketplace.

“Is there a culture of innovation? Is there a culture of dialogue around innovation? So many companies I go to that aren’t here (at that point)… they live in denial or hope. They still think that something outside their sphere of influence is going to change their fortunes. It’s very sad.

“Or they are waiting for the government? Or they are waiting for their friends or they are waiting for another company to change their fortunes?

“I find that the leadership of many companies comes from the backgrounds of logistics, finance or manufacturing or engineering – not from sales.”

Although sales is the life blood of business, Mr Lang believes that in Australia the sector is maligned and that is a mind-set which must change.

“So they (leadership) actually see sales, or revenue generation as a black art,” Mr Lang said. “Even sales people … they actually have a negative identity around sales.

“Pushy, slimy used car salesman, right? So they don’t want to be part of that.

“When I’m engaging with leaders, I’m saying unless you are willing to get on board this isn’t going to work, because you are actually going to undermine it unconsciously,” Mr Lang said.

SUCCESS SESSION

SG Partners recently opened its new leadership workshop series at Central Dockside in Brisbane, with inductees ranging from industrial to internet and other services company leaders. That workshop focused on Improving Leadership.

It is evidence that SG Partners practises what it preaches on diversity and innovation. One of its new clients, for example, is a major aged care company.

After learning about using NLP tools and strategies to change their own ‘state’ and moving on to influence others in their organisation, SG Partners trainers moved workshop participants through realistic scenarios, offering personal advice and questioning individual habits. A lot of time and effort was spent on workshopping how to conduct and manage a successful and energising team.

“We now have a diverse group of clients,” Mr Lang said. “Contractors, industrial suppliers, IT, engineering firms … and we did some work for a retirement home company and a nursing contracting company.”

Never content to leave a looming problem alone, Mr Lang is now turning SG Partners’ expertise to address the financial services sector.

“I am looking at the financial services sector because there is a dramatic trigger point coming,” Mr Lang said. That trigger point is the changes to the financial services sector by Federal Government legislation, focused on ethical behaviour.

Mr Lang said changes included an independent Standards Board and a precedent for professionals employed in the industry to first undertake a degree, professional year and exam (for new advisers) or an appropriate degree equivalent (for existing advisers).

The challenge was large, because of the recent track record of the industry in Australia and the imperative to change the mind-set of financial advisors towards earning their livings from great client service rather than ‘hidden’ commissions from financial institutions.

“It is the most highly regulated industry. It’s fascinating really,” Mr Lang said. “The trigger point the government is bringing via further regulations will change the way financial services people are remunerated, requiring even more transparency, which means they will have to engage even better with their clients.”

Mr Lang said the 451,000 Australian jobs in the sector makes it crucial to the economy – and therefore it needed to provide the highest standards of service to customers.

“As one of Australia’s fastest growing industries, it is important that employees in financial services are receiving the training they need,” Mr Lang said. “What we will see is young graduates coming into the industry, who although qualified, have not had client engagement training and do not have the skillset to engage with clientele and get the very best outcome from them. That’s where SG Partners can help.”

Mr Lang outlined the fundamental challenge ahead for the sector.

“If I am selling you a financial plan which is going to grow your assets, and your wealth, before you used to pay for over time,” he said

“Now, if I am selling to you, I’ve got to ask you to pay for my advice. There is a whole different conversation going to happen there.

“The people in the industry have not been used to that so they are scared about bringing it up and talking about you having to pay upfront. Or they are scared about having to get you to commit. They have never had to do it before, they do not have the skills. They don’t have the culture. They don’t have the leadership that understands how to do that.”

Mr Lang sees the key challenge as being how to educate the sector’s leadership to guide that change.

“I listen to the financial services industry and they still use words, “we are not the trusted advisor”. “We have to train our people on integrity”.

“Really? It’s 2016! What type of culture do you have in the company that you believe you have to train on integrity? Where are they learning about integrity? Where are they learning about trust?

Mr Lang said the fundamental problem was the sector to date operated in a ‘high risk, high reward’ ecosystem.

“With high risk comes different value systems,” he said. “We reward people’s behaviour. If we are going to reward people’s behaviour for taking risks, therefore that is the culture we are creating, isn’t it?

“And then if you get caught, don’t complain … you created that culture.

“Part of the challenge with public companies is that they usually have a 3-5 year mandate before the CEO or MD changes. Is that long enough to change a culture? No. That is why they have to be given some depth and breadth to do that.

“I wonder, are they (the leaders) incentivised to do it? Are the leaders incentivised to say, you know, we’ve got a culture problem, this is what we need you to focus on? You fix that and everything else will follow.”

Mr Lang said SG Partners has long realised that changing behaviour is about understanding ‘patterns’ – and changing them. That was what the recent workshop focused upon.

“Everything we do is about patterns,” Mr Lang said. “Patterns of individuals in that workshop: here is your pattern, here is your outcome. If you want to change your outcome, here is where you need to change your patterns.”

The workshop’s role playing inspired participants to imagine what they were going to do differently in their businesses and how they were going to behave differently once they got back to their organisations.

Mr Lang said SG Partners training was practical

“At the end of the workshop I will ask them: you need to pick three things. Go and do those three things within your organisation,” he said.

“You are not going to do everything, but just pick three things. And the human spirit kicks in … once they start to see some traction they will want more and the snowball forms and suddenly it gets momentum.”

“Great leadership is about giving a shift,” Mr Lang said he tells those in his workshops. “It is about caring for the individual in front of you, asking questions, listening and tapping into them. Then they feel that you care and they will follow you.

“So, I’ve got to learn to care. I’ve got to learn to slow down. I’ve got to ask some great questions. I’ve got to give feedback so that the individual is actually being heard.”

Mr Lang’s second piece of advice at the workshop was to focus on ‘pay it forward leadership’.

“I challenge them to go forward and share what they are doing with others. Because life is a lot easier when everyone rises to the next level,

“Spread the word. Because when we spread the word we re-learn as well. Too many times training is seen as, I’ve learnt something now, all I have to do is practise it.

“No. Go and share it with others. Get everyone else on board. It will be a lot easier.”

While the workshops focus on equipping participants with the tools and strategies to succeed in boosting revenue across the board while building organisational effectiveness, putting that into practice often requires follow-through from SG Partners.

“Typically our engagement is over about a two-year period with a company, to turn the ship around, to get people aligned, to improve their mind sets and give them some new skills. And then embed it.”

The way to accomplish that is simple.

“If you really want to be good at it, you need to be practising and be coached,” Mr Lang said. “Dare I say it, the top golfers have four coaches, one focussed on every aspect of their game.

“In my experience, the best and most successful leaders take an elevated view and look for where they themselves may be falling short and then they are more able to see where others in their organisations can benefit from some assistance.”

It’s not mind over matter, it’s minding over what really matters.

www.sgpartners.com.au