Business News Releases

ARA: Casuals are the key to retail success

WITH the Australian retail industry employing over 10 percent of the total working population, the Australian Retailers Association (ARA) strongly believe that casual workers and their flexible hours are crucial to the survival of retail.

Russell Zimmerman, Executive Director of the ARA, said restricting casual employment would only bring further challenges to Australian retailers who are already facing a difficult operating environment.

“With the Christmas period coming to an end, and crowds of shoppers entering stores across the country during increased trading hours, the flexibility of casual retail employees is crucial,” Mr Zimmerman said.

“Last week we saw foot-traffic increase by 13 percent year-on-year, and without the flexibility of casual employees, Australian retailers would not have been able to staff their stores adequately during the busiest time of the year.”

The ARA believe retailers see employees as a vital part of their business, and therefore know retailers would be happy to offer a fixed number of hours to part-time employees, however Mr Zimmerman continues to stress the importance of flexibility needed in the sector.

“If the unions want permanent employment, then we would need to see more flexibility around the hours of work, and the notification period of roster changes for part-time employees,” Mr Zimmerman said.

“Under the current General Retail Industry Award (GRIA) retailers are restricted in their ability to offer additional hours to part-time employees, and must provide part-time employees seven days written notice if there will be any changes to the roster.

“With unpredictable trading hours in the industry, retailers need to be able to add hours to staff without paying overtime penalties, especially during busy trading periods like Christmas.”

The ARA understands from various retailers that the majority of casual staff enjoy the flexibility in choosing their own hours, and would like to maintain their casual loading as casual staff are adequately compensated for their type of employment.

“Last minute changes always arise in retail and if retailers need to provide their staff seven days notice for each change to the roster, the sector will begin to suffer,” Mr Zimmerman said.

“With ongoing challenges affecting the retail industry and rising energy costs, small and medium retailers will not have the capability to give the required notice to part-time employees and would then end up staffing their stores themselves.”

The ARA believe the existing GRIA provisions around part-time employees and the inefficiencies around Enterprise Bargaining Agreements (EBA)s emphasise the necessity of casual employees.

“This ploy is just another example of the unions losing the fight before the Fair Work Commission,” Mr Zimmerman said.

“The unions already ran a case to convert casual retail employees to permanent retail employees after six months, and the Full Bench of the Fair Work Commission assessed the case and unanimously rejected it.

“The unions need to understand the Fair Work Commission was established as the independent umpire, by former Prime Minister Julia Gillard, when she was Minister for Employment, and the unions must accept the decision of the Full Bench,” Mr Zimmerman said.

About the Australian Retailers Association:

Founded in 1903, the Australian Retailers Association (ARA) is the retail industry’s peak representative body representing Australia’s $310 billion sector, which employs more than 1.2 million people. The ARA works to ensure retail success by informing, protecting, advocating, educating and saving money for its 7,500 independent and national retail members throughout Australia. For more information, visit www.retail.org.au or call 1300 368 041.

ends

Boxing Day all wrapped up for 2017

WITH crowds of consumers flooding in-store and website traffic peaking to its highest this year, Boxing Day proved to be another successful day for retailers across the country as the Australian Retailers Association (ARA) tipped this year’s Boxing Day sales to reach $2.4 billion.

Russell Zimmerman, ARA Executive Director, said bricks-and-mortar retailers were happy with the steady stream of customers entering their stores throughout the day and were thankful to shoppers who waited patiently in queues due to the rise in foot-traffic across physical retailers throughout the nation.

“This year the ARA predicted retailers would trade almost $2.4 billion this Boxing Day, and judging by the increase in foot-traffic and shoppers lining outside bricks-and-mortar stores, I think we may have hit the mark,” Mr Zimmerman said.

“Every year Boxing Day crowds seem to grow, however with the growth of online retail the ARA believe many Australians got their bargains online this year, with consumers choosing to click through websites to take advantage of the best sales of the year.”

This Boxing Day, Myer expected to have 1.6 million customers flood through their doors after launching their biggest Stocktake Sale with up to 70 percent off a wide range of brands and products.

“Aussie consumers enjoyed savings across the board this Boxing Day, with 30-50 percent off selected clothing from Cue, MARCS, David Lawrence, Country Road, Seed and French Connection,” Mr Zimmerman said.

“Myer’s super Stocktake Sale also include up to 70 percent off cookware by Circulon, up to 50% off small appliances and up to 40% off women’s clothing by Mossman, Tommy Hilfiger and Wayne Cooper.”

As Boxing Day is only the start of the sale period, the ARA and Roy Morgan Research expect shoppers to spend $17.9 billion from December 26, 2017 to January 15, 2018.

“We anticipate consumers to continue taking advantage of the best retail sales of the year for the next two or three weeks, both in-store and online,” Mr Zimmerman said.

The category tipped to enjoy the biggest increase in post-Christmas sales over the next three weeks will be the Other Retailing category as the ARA and Roy Morgan have predicted a 4% boost in post-Christmas sales for this category.

“With online shopping accounting for more than 7% of total retail sales and looking to account for 15% in the next five years we believe physical retailers will not be the only retailers to receive an increase in post-Christmas sales,” Mr Zimmerman said.

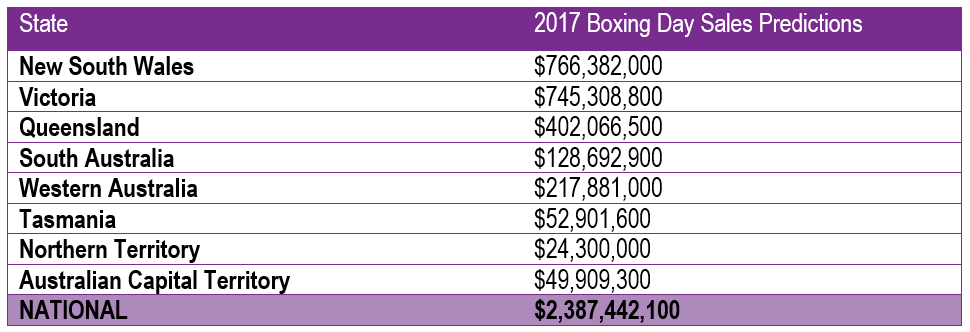

ARA Boxing Day 2017 sales predictions , December 26, 2017

Boxing Day 2017 sales

[ARA]

ARA and Roy Morgan Research post-Christmas sales predictions

December 26, 2017 – January 15, 2018

2017/2018 Post-Christmas sales growth by category

|

State |

2016 Post-Christmas actual results ($mil) |

2017 Forecast Post-Christmas sales ($mil) |

Predicted Growth |

|

FOOD |

7027 |

7267 |

3.40% |

|

HH GOODS |

3015 |

3075 |

1.98% |

|

APPAREL |

1381 |

1400 |

1.33% |

|

DEPARTMENT STORES |

1044 |

1062 |

1.73% |

|

OTHER |

2465 |

2564 |

4.02% |

|

HOSPITALITY |

2455 |

2525 |

2.85% |

|

NATIONAL |

17387 |

17892 |

2.90% |

[ARA / Roy Morgan]

2017/2018 Post-Christmas sales growth by state

|

State |

2016 Post-Christmas actual results ($mil) |

2017 Forecast Post-Christmas sales ($mil) |

Predicted Growth |

|

NSW |

5593 |

5828 |

4.20% |

|

VIC |

4384 |

4528 |

3.28% |

|

QLD |

3501 |

3566 |

1.85% |

|

SA |

1139 |

1171 |

2.86% |

|

WA |

1927 |

1935 |

0.39% |

|

TAS |

346 |

356 |

2.91% |

|

NT |

178 |

180 |

1.19% |

|

ACT |

320 |

329 |

2.83% |

|

NATIONAL |

17387 |

17892 |

2.90% |

[ARA / Roy Morgan]

About the Australian Retailers Association:

Founded in 1903, the Australian Retailers Association (ARA) is the retail industry’s peak representative body representing Australia’s $310 billion sector, which employs more than 1.2 million people. The ARA works to ensure retail success by informing, protecting, advocating, educating and saving money for its 7,500 independent and national retail members throughout Australia. For more information, visit www.retail.org.au or call 1300 368 041.

ends

All is calm, all is bright, Boxing Day sales a big delight

WITH the biggest trading day of the year upon us, retailers across the country are looking for a substantial trade this Boxing Day as the Australian Retailers Association (ARA) predict Australians to spend almost $2.4 billion in just 24 hours.

With the ARA and Roy Morgan forecasting consumers to spend a total of $17.9 billion nationwide from December 26, 2017 to January 15, 2018, Boxing Day traditionally signifies the start of the post-Christmas sales period.

Russell Zimmerman, Executive Director of the ARA said although pre-Christmas sales are usually very strong for retailers, Boxing Day is the pinnacle of retail trade globally, with online and physical retailers preparing for this day months in advance.

“Our annual research with Roy Morgan has identified a 2.9 percent increase in post-Christmas sales this year, and with Boxing Day marking the start of the post-Christmas trading period, retailers across the country are excited that this day has finally arrived,” Mr Zimmerman said.

“Following the back of our post-Christmas predictions with Roy Morgan, the ARA’s analytics team have estimated Aussie shoppers to spend almost $2.4 billion this Boxing Day in-store and online.”

With the NSW Government finally legislating Boxing Day trade across all parts of NSW this year, the ARA expect NSW retailers to see the biggest Boxing Day sales across the nation.

“Due to the new deregulated trading hours in NSW, we predict NSW consumers to spend over $766 million and forecast Victorians to spend roughly $745 million this Boxing Day,” Mr Zimmerman said.

“Physical retailers should be prepared for an onslaught in foot-traffic and online retailers will need to ensure their online functionalities are strong enough for the increased website traffic they will receive across their online and social platforms in the next 24 hours.”

With new global giants entering the Australian retail market, the ARA believe local retailers are putting their front foot forward, adapting to consumer demand and ensuring they are in-line with the increased competitive market.

“As convenience is key for today’s consumers, retailers who have ensured their physical stores are accurately staffed will not only thrive today, but see further growth in the new year,” Mr Zimmerman said.

“Although Boxing Day is known as the biggest day of the year for retail discounts, sales will continue beyond December 26 into the new year, giving shoppers plenty of opportunities to grab a good bargain or two.”

ARA and Roy Morgan Research post-Christmas sales predictions

December 26, 2017 – January 15, 2018

2017/2018 Post-Christmas sales growth by category

|

State |

2016 Post-Christmas actual results ($mil) |

2017 Forecast Post-Christmas sales ($mil) |

Predicted Growth |

|

FOOD |

7027 |

7267 |

3.40% |

|

HH GOODS |

3015 |

3075 |

1.98% |

|

APPAREL |

1381 |

1400 |

1.33% |

|

DEPARTMENT STORES |

1044 |

1062 |

1.73% |

|

OTHER |

2465 |

2564 |

4.02% |

|

HOSPITALITY |

2455 |

2525 |

2.85% |

|

NATIONAL |

17387 |

17892 |

2.90% |

[ARA / Roy Morgan]

2017/2018 Post-Christmas sales growth by state

|

State |

2016 Post-Christmas actual results ($mil) |

2017 Forecast Post-Christmas sales ($mil) |

Predicted Growth |

|

NSW |

5593 |

5828 |

4.20% |

|

VIC |

4384 |

4528 |

3.28% |

|

QLD |

3501 |

3566 |

1.85% |

|

SA |

1139 |

1171 |

2.86% |

|

WA |

1927 |

1935 |

0.39% |

|

TAS |

346 |

356 |

2.91% |

|

NT |

178 |

180 |

1.19% |

|

ACT |

320 |

329 |

2.83% |

|

NATIONAL |

17387 |

17892 |

2.90% |

[ARA / Roy Morgan]

About the Australian Retailers Association:

Founded in 1903, the Australian Retailers Association (ARA) is the retail industry’s peak representative body representing Australia’s $310 billion sector, which employs more than 1.2 million people. The ARA works to ensure retail success by informing, protecting, advocating, educating and saving money for its 7,500 independent and national retail members throughout Australia. For more information, visit www.retail.org.au or call 1300 368 041.

ends

Retailers believing in the magic of post-Christmas sales

THE Australian Retailers Association (ARA) and Roy Morgan believe Aussies will continue their summer shopping long after Christmas day, predicting consumers to spend $17.9 billion nationwide from December 26, 2017 to January 15, 2018 and forecasting shoppers to increase their post-Christmas spend by 2.9 percent.

Russell Zimmerman, Executive Director of the ARA, said he is looking forward to a substantial post-Christmas trade as bargain hunters seek out both online and physical retailers for the best deals across the industry.

“Traditionally pre-Christmas sales are an exciting time for retailers, however, post-Christmas sales are that extra cherry on top for many retailers trying to increase their yearly sales and meet targets before they head into the new year,” Mr Zimmerman said.

“With Amazon’s recent Australia launch, we are certain that online retail will be a driving force for post-Christmas sales with the ARA and Roy Morgan forecasting the Other Retailing category to increase by more than 4 percent this year.”

According to the ARA and Roy Morgan’s Annual Post-Christmas Trading Predictions, Other Retailing, Food Retailing and Hospitality Retailing will see the biggest sales growth across the industry this year.

“We are expecting Food Retailing to see a 3.4% spike in sales during the post-Christmas trading period, as many food retailers will be discounting their fresh produce post-Christmas for families spending time at home during the holidays,” Mr Zimmerman said

“Our in-depth research with Roy Morgan also forecasts a 2.8% increase for Hospitality Retailing, as market research has identified the summer holidays are an exciting time for Australians to celebrate the end of the year with their friends at cafés and bars across the country.”

New South Wales will see the strongest post-Christmas sales growth with the ARA and Roy Morgan predicting the region to spend almost $6 billion after Christmas; a 4.2 percent increase in New South Wales sales from last year.

“We are also expecting Victorian retailers to see a 3.3 percent spike in post-Christmas sales this year as Victoria is the fashion capital of Australia,” Mr Zimmerman said.

“South Australia, Tasmania and the Australian Capital Territory are also likely to receive a substantial increase in post-Christmas sales, as Australians across the country will be seeking retail bargains both online and in-store.”

Every year, the ARA proudly partners with Roy Morgan Research to deliver the only professionally researched retail figures in the industry, with proven year-on-year results.

“Although there have been various disruptions to the Australian retail market throughout the year, we look forward to seeing our pre-Christmas and post-Christmas predictions come to fruition when the retail trade figures are released in the new year,” Mr Zimmerman said.

“With online retail accounting for more than 7% of total retail sales, we urge retailers to understand the new technologies available to them, including Roy Morgan’s new Audiences tool which assists retailers in measuring their digital audiences in peak shopping periods like post-Christmas trade.”

ARA and Roy Morgan Research post-Christmas sales predictions

December 26, 2017 – January 15, 2018

2017/2018 Post-Christmas sales growth by category

|

State |

2016 Post-Christmas actual results ($mil) |

2017 Forecast Post-Christmas sales ($mil) |

Predicted Growth |

|

FOOD |

7027 |

7267 |

3.40% |

|

HH GOODS |

3015 |

3075 |

1.98% |

|

APPAREL |

1381 |

1400 |

1.33% |

|

DEPARTMENT STORES |

1044 |

1062 |

1.73% |

|

OTHER |

2465 |

2564 |

4.02% |

|

HOSPITALITY |

2455 |

2525 |

2.85% |

|

NATIONAL |

17387 |

17892 |

2.90% |

[ARA / Roy Morgan]

2017/2018 Post-Christmas sales growth by state

|

State |

2016 Post-Christmas actual results ($mil) |

2017 Forecast Post-Christmas sales ($mil) |

Predicted Growth |

|

NSW |

5593 |

5828 |

4.20% |

|

VIC |

4384 |

4528 |

3.28% |

|

QLD |

3501 |

3566 |

1.85% |

|

SA |

1139 |

1171 |

2.86% |

|

WA |

1927 |

1935 |

0.39% |

|

TAS |

346 |

356 |

2.91% |

|

NT |

178 |

180 |

1.19% |

|

ACT |

320 |

329 |

2.83% |

|

NATIONAL |

17387 |

17892 |

2.90% |

[ARA / Roy Morgan]

About the Australian Retailers Association:

Founded in 1903, the Australian Retailers Association (ARA) is the retail industry’s peak representative body representing Australia’s $310 billion sector, which employs more than 1.2 million people. The ARA works to ensure retail success by informing, protecting, advocating, educating and saving money for its 7,500 independent and national retail members throughout Australia. For more information, visit www.retail.org.au or call 1300 368 041.

ends

ACCC approves ARA amendments to pop-up code

THE Australian Retailers Association (ARA) welcomes the announcement from the Australian Competition and Consumer Commission (ACCC) to re-authorise an amended Casual Mall Licensing Code of Practice (Code) today. The Code in its current form has led to a number of issues for retailers and the unfair introduction of external competitors to shopping centres across the country.

The ARA’s long running campaign to change the Code has resulted in a victory for retailers battling against unscrupulous landlords. The ARA sought to make changes to the Code’s dispute resolution process, as well as the Code Administration Committee, which has been ineffective at administering and maintaining the Code over the last five years.

The ongoing issues with the Code have led to the unreasonable introduction of external competitors to shopping centres, especially at peak periods, which is hurting retailers and disrupting their businesses.

Russell Zimmerman, ARA Executive Director, said the ACCC had delivered a win for retailers just before Christmas, the busiest time of the year for the industry.

“The news couldn’t come soon enough for retailers, who have endured skyrocketing rents and a barrage of pop-up shops right outside their stores at some of the busiest times of the year,” Mr Zimmerman said.

“We now have a mandate from the ACCC to push ahead with making the necessary changes to the Code to ensure it is fair for everyone concerned.”

The ARA would like to thank the Australian Sporting Goods Association (ASGA), Franchise Council of Australia (FCA) and Pharmacy Guild of Australia (PGA) for their ongoing support in amending the current Code.

Mr Zimmerman said he was quite stunned to see the National Retailers Association (NRA) abandon retailers in favour of their landlord friends at the Shopping Centre Council of Australia (SCCA).

“It was astounding to see the NRA standing on the side of unfair competition and supporting the standover tactics of landlords when it comes to pop-up shops,” Mr Zimmerman said.

“The ACCC have had to drag landlord advocates like the NRA to the adult’s table this Christmas. However, these efforts have not gone unnoticed as shopping centres will no longer be able to introduce unfair competition, or bully their tenants into submission when they make a reasonable request.”

The FCA and PGA will now join the ARA on the CAC, ensuring a fair and balanced approach to casual mall leasing.

“The ARA will continue to seek fairness across the tenancy space for retailers and will ask the ACCC for regulatory intervention if the current issues are not addressed,” Mr Zimmerman said

“The proof of the pudding will be in the eating. All parties to the Code need to work together to address its issues, and ensure it operates in the interests of fairness for retailers across the board.”

To view the ARA’s submission to the ACCC, please click here.

About the Australian Retailers Association:

Founded in 1903, the Australian Retailers Association (ARA) is the retail industry’s peak representative body representing Australia’s $310 billion sector, which employs more than 1.2 million people. The ARA works to ensure retail success by informing, protecting, advocating, educating and saving money for its 7,500 independent and national retail members throughout Australia. For more information, visit www.retail.org.au or call 1300 368 041.

ends

IPA pre-Budget submission 2018-19

THE Institute of Public Accountants (IPA) has issued its pre-Budget 2018/19 submission to Government with key recommendations around holistic tax reform; state-backed loan guarantee schemes; publicly supported venture capital funding; investment in innovation; and legislating payment times to benefit small business.

“The IPA continues to put the case forward for major tax reform which has been a pill too hard to swallow for the major political parties,” said IPA chief executive officer, Andrew Conway.

“We are calling on the Government to deliver the much promised and almost forgotten tax reform white paper to take a long term view and encourage genuine public debate on tax reform.

“One of the main considerations is a rebalancing of the tax mix.

“We are also asking the Government to introduce a state-backed loan guarantee scheme to help increase the availability of much-needed affordable loan finance to the small business sector.

“In addition, we are recommending that the Government introduce a publicly supported venture capital (VC) fund in order to encourage the private sector to follow the Government’s lead in boosting the entrepreneurial culture.

“We also believe that the Government’s National Innovation and Science Agenda can be furthered by encouraging innovation policy to support innovative small to medium enterprises in Australia,” said Mr Conway.

Further information on the IPA’s recommendations can be found at http://bit.ly/2BU30Jm

ends

New SMSF auditor registration fee out of this world

THE proposed increase in registration fees for new auditors of self-managed superannuation funds (SMSF) appears to be excessive according to the Institute of Public Accountants (IPA).

“A one-off fee increase from $107 to $3,429 is exorbitant. Even more unfathomable is that an auditor exiting the sector will be hit with a deregistration fee of $899,” said IPA chief executive officer, Andrew Conway.

“The ATO currently already collects $259 from each SMSF to finance the SMSF monitoring role the ATO conducts on behalf of ASIC.

“This levy was a mere $45 in 2008 but now equates to approximately $142.5M (550,000 SMSFs multiplied by $259) to monitor the sector including SMSF auditors.

“In 2011/12, the Government provided ASIC with $10.7M over five years, to develop and maintain an online registration system for auditors of SMSFs. ASIC also developed a competency exam for auditors, enabling ASIC to deregister non-compliant auditors.

“The Government also gave the ATO $10.6 million over five years to police registered auditors, check their compliance with competency standards set by ASIC and where necessary, refer non-compliant auditors to ASIC for appropriate punishment.

“Some of the funding for the SMSF auditor registration process was also sourced by ASIC charging auditors to sit the SMSF auditor competency exam.

“Surely, the fee increases under the proposed fees-for-service funding model must take into account the money already being collected via the ATO supervisory levy.

“While we understand the objectives of the new funding model and the role of ASIC, we have a major concern over the impact these fees will have on competition, especially when there has already been a decline in the number of SMSF auditors in a market which is being dominated by the major players.

“SMSF auditors, who are members of one of the three professional accounting bodies, such as the IPA, are already well regulated in our co-regulatory system, which requires them to maintain their professional and ethical standards.

“We are calling on the Government to reconsider the proposed fee increases which will deter new entrants from entering the market,” said Mr Conway.

ends

Coal delivers again for the budget

THE Queensland Resources Council (QRC) today called for the State Government to stand-up for the resources sector and to acknowledge coal’s fiscal value to the state budget and the thousands of coal workers who help deliver the royalties.

QRC Chief Executive Ian Macfarlane said the Mid-Year Financial Economic Review (MYFER) yet again showed resources, especially coal, underpin the budget.

“Coal royalties are expected to reach $414 million above the 2017-18 budget forecast or $3.16 billion forecast over the financial year. Revenues from all resources including coal, gas and metals not only pay the wages of teachers, nurses and police they build the schools, hospitals and police stations,” Mr Macfarlane said.

“The extra coal royalties alone would pay for the North Queensland Stadium ($250 million), four schools such as the new state school at Caloundra South (4 x $34 million) and three police stations in the regions (3 x $8.3 million).

“For the second year in a row resources have delivered an early Christmas present for the government and all Queenslanders. When the resources sector is doing well, the entire Queensland economy benefits.

"The sector continues to be a mainstay of employment and economic growth in Queensland, ensuring that every Queenslander benefits from this great industry."

Last financial year the sector generated $55.1 billion in economic prosperity for the state and achieved this contribution while using only 0.1 per cent of Queensland’s land mass.

ends

Australian industry opportunities for future submarines

MINISTER for Defence Industry, Christopher Pyne MP, has announced Naval Group has released expressions of interest and requests for information to help get Australian industry involved in Australia’s Future Submarines.

Mr Pyne said Naval Group was seeking Australian industry ‘know how’ as the $50 billion Future Submarine Program continued to gather momentum.

“The Turnbull Government is committed to a sovereign naval shipbuilding capability and this includes 12 regionally superior submarines for our Navy,” Mr Pyne said.

“These submarines will be built in Australia, by Australians, which will maximise local industry involvement in all phases of the program."

So far around 130 companies have been pre-qualified by Naval Group to be part of the program.

“Naval Group continues to support the Turnbull Government in this endeavour and is looking to Australian industry to manufacture and supply critical equipment and other common technologies for the submarines," Mr Pyne said.

“Opportunities exist for Australian industry to provide everything from electrical, mechanical, heating and air conditioning equipment, to castings, steel and titanium products.

“This is part of a wider suite of activities aimed at collecting information on industry’s capability to supply products and technologies required to manufacture and sustain the Future Submarines in Australia.

“These are the first major equipment information requests released by Naval Group, with more scheduled for release progressively throughout 2018, and complemented by the continuation of industry briefing days.

“Australian industry involvement in the Future Submarine Program is expected to generate an annual average of around 2,800 jobs over the life of the Program,” Mr Pyne said.

Companies wanting to know more about the program or respond to Naval Group’s request can visit the Future Submarine Industry Capability Network Gateway:

https://gateway.icn.org.au/project/3915/naval-group-future-submarine

The deadline for interested companies is January 5, 2018.

ends

Launch of Commonwealth Contracting inquiry

THE Joint Committee of Public Accounts and Audit has launched a new inquiry into Commonwealth Contracting. The inquiry is based on the Auditor-General’s Information Report—Australian Government Procurement Contract Reporting(Audit Report No. 19, 2017–18).

The Committee’s inquiry will examine matters raised by the Auditor-General’s insights on contract information reported over a five-year period (2012–13 to 2016–17) in AusTender — the Australian Government’s centralised publication of contract notices. Particular areas included:

- the volume and value of Government procurement contracts;

- entities’ procurement contract behaviour as it relates to the timing of procurements during each financial year; and

- reporting on the number and value of contracts undertaken with Small to Medium Enterprises.

The Committee invites submissions to the inquiry addressing the terms of reference. Submissions are requested by 16 February 2018, with public hearings held from February 2018. Complementary Submission Guidance, which highlights the Committee’s five areas of focus, has also been prepared to assist submitters with their respective input to the inquiry.

Committee Chair Senator Dean Smith said Commonwealth contracting was worth $47.4 billion in 2016–17 and was an area of public expenditure that deserved close and constant scrutiny.

“Effective procurement contract behaviour is vital and transparency in contract reporting is critical so that the Government can assure itself and the Australian public that entities are achieving their objectives in an efficient and cost-effective manner,” Senator Smith said.

Interested members of the public may wish to track the committee via the website.

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?