THE Palaszczuk Government's shock decision in the State Budget to increase the rate of royalty taxes on gas by 25 percent threatens regional Queensland jobs, investment and exports, the Queensland Resources Council (QRC) has warned.

With resources royalties this year forecast to hit unprecedented highs of $5.45 billion, including $4.34 billion from coal, QRC chief executive Ian Macfarlane said the Palaszczuk Government had betrayed the trust of the 315,000 Queenslanders who work in the resources sector, especially in regional Queensland.

“Premier Annastacia Palaszczuk and Treasurer Jackie Trad have broken a promise and broken their word to regional Queenslanders,” Mr Macfarlane said.

“Regional Queenslanders will be at a loss to understand how they can trust a Government that says one thing one week, and something completely different the next. In Townsville two weeks ago the Premier said: ‘there will be no royalty increase in this year’s budget’.

“Today we discover that’s not the case," Mr Macfarlance said.

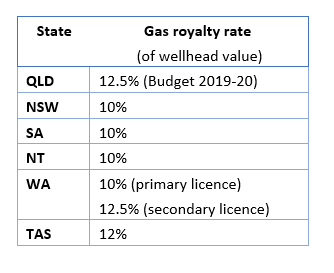

“After weeks of refusing to rule out hiking coal royalty rates, the Palaszczuk Government has blindsided the resources sector with an increase in royalty taxes from 10 percent to 12.5 percent on petroleum including liquefied natural gas (LNG) extracted in western Queensland and exported from Gladstone.

“This will make Queensland gas less competitive and will risk jobs and future investment and the creation of new jobs. It will also make lower emission energy generated from gas more expensive and increase the cost of gas to manufacturers such as Incitec Pivot in Brisbane," he said.

“To make matters worse, Queensland is the only state on the East Coast that is developing its gas resources. This tax hike risks the gas supply for all Australians, not only Queenslanders, given Queensland gas suppliers have been doing all the heavy lifting for the gas market.

“Billions were poured in Queensland’s world-leading gas industry based on export models, while at the same time supplying the gas that domestic manufacturers need to sustain their industries and protect jobs. Today’s royalty tax increase casts a dark cloud over future growth in the Queensland gas industry.

“In Parliament today the Premier, the Treasurer and other Ministers repeatedly said they backed Queensland jobs. But this tax hike on the gas industry means they are risking jobs.

"As Trade Minister, the Premier has recently lauded the role of LNG in driving Queensland exports to record levels. To apply an extra tax to gas undermines Queensland's trading performance, future investment, and current and future jobs in regional Queensland.”

Mr Macfarlance said tast month, the Premier had said: "Our commodities, from LNG to beef, are delivering valuable export dollars to Queensland and supporting thousands of jobs".

“The best policy comes only through consultation. Unfortunately the Palaszczuk Government has failed that test,” Mr Macfarlane said.

“The Premier recently said she was fed up with the way her Government was handling resources approvals. Well Queenslanders are fed up with the mixed messages from the Palaszczuk Government.

“Either you back resources jobs, or you don’t. And right now the only evidence is that the Palaszczuk Government doesn’t back long-term jobs in the resource sector.

“The LNP has committed to a royalty freeze through until the end of the next term of Parliament if it wins the election. This would provide royalty tax stability through until October 2024. The QRC has urged the Palaszczuk Government to match that commitment and we will continue to do so.

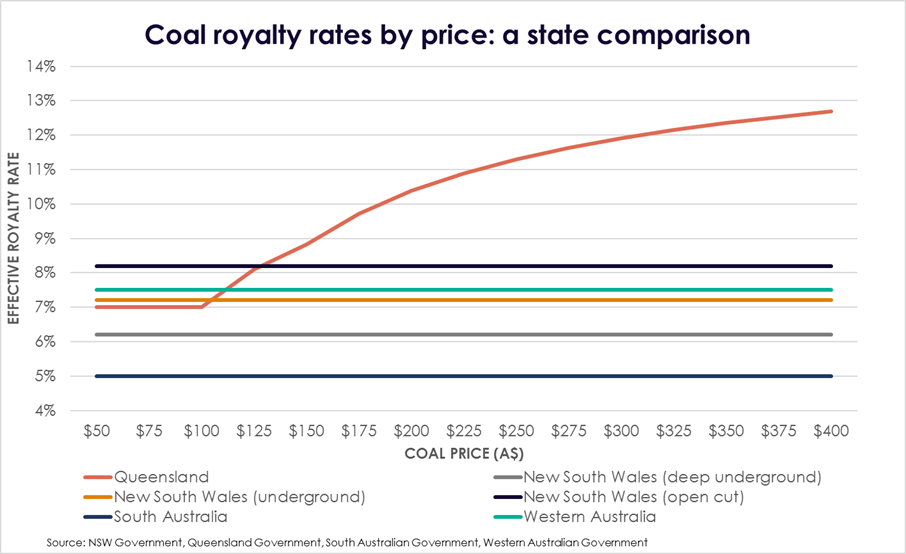

“There is no case for increasing the rates of royalty taxes paid by resources companies. At current market prices, Queensland already has the highest rates of coal royalty taxes of any state in Australia.

"This means that when prices are high all Queenslanders benefit from greater returns.

“By changing the royalty rate structure Queensland risks losing its competitiveness in global commodity markets. In effect, the Palaszczuk Government is threatening the goose that lays the golden egg. And as today’s budget illustrates, Queensland cannot afford to do that.”

www.qrc.org.au

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?