Construction recovers but regional Australia drives economy

NEW RESEARCH released this week by credit bureau illion, an Experian company, as part of its Commercial Risk Barometer, reveals business failure risk has continued to improve over the last quarter (August–October 2024).

This improvement is not uniform across industries and regions, however, with some still deteriorating.

Construction industry turns corner

Most notably, the construction industry has improved, where business failure risk was down 0.2 percent in the September quarter, suggesting that more favourable trading conditions are beginning to appear in what has been a long period of economic fragility for the sector.

“Illion’s data showed that trading growth in this sector is now outpacing inflation, which may finally translate into more stable cash flows and fewer construction businesses in financial stress,” illion’s head of modelling, Barrett Hasseldine said.

Illion’s data showed the construction sector’s annual growth significantly outpaced inflation, rising by more than 10 percent year on year. Rising trade activity from higher consumption contributed to this growth, suggesting that businesses are beginning to see more positive cash flows again.

Improvement in the failure risk of construction businesses may be attributed to better servicing of invoice payments, reducing the risk of insolvencies.

“From the data, we are seeing a 6 percent improvement in the time taken to pay invoices, and this is also coinciding with greater trading activity,” Mr Hasseldine said.

“We therefore believe that the construction sector may now be operating with more stable and sustainable cash flows, which is great news. Hopefully this translates into lower insolvency rates through 2025, contingent on the state of the broader economy.

“Although a small percentage of construction businesses are still struggling to meet their financial obligations, the majority are doing better than they were.”

Other sectors ‘a mixed bag’

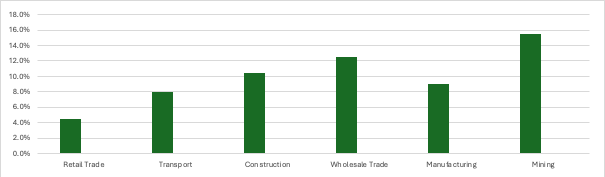

In other sectors, mining and wholesale trade have also continued to go from strength to strength, each now being more than 40 percent lower risk than the national average. Growth in the mining sector rose a huge 16 percent year-on-year, where ‘wholesale trade’ improved a very respectable 12 percent.

“The mining sector, together with agriculture, has contributed to business failure risk in regional Australia being lower than metro Australia,” Mr Hasseldine said.

However, illion’s data did show that other sectors are of concern.

The utility sector has deteriorated somewhat, with illion’s analysis showing that its failure risk rose by 1.4 percent in the September quarter, due in part to a 10 percent reduction in consumer spending and the payment of trade invoices taking 5 percent longer.

“The lower consumer spending may simply be due to lower energy tariffs, but if consumption were to fall beyond normal seasonal variations, the failure risk of utility businesses could rise in 2025; especially as overdue invoices are already on the rise in this sector,” Mr Hasseldine said.

“Any indication of further deterioration would therefore need to be closely monitored.”

Food services sector struggles

Illion’s Commercial Risk Barometer highlighted that sectors such as the food services industry also continue to struggle, with the business failure risk remaining 40 percent higher than the national average.

The data showed that although the sector has experienced a 10 percent rise in consumer spending over the September quarter, this has made little impact, with the sector also seeing a 20 percent rise in the time taken to pay late invoices. This has gone from 16 days on average in June 2024, to 19 days in Sept 2024.

“While it might not sound a lot, it makes a big difference – in addition, the sector has also seen a 1 percent rise in failure risk over Q3,” Mr Hasseldine said.

“While higher spending is a promising sign of business activity, the challenges that the food services sector faces with invoice payments suggests that a proportion of its businesses may find a difficult road ahead.”

Overall, illion’s data shows that some industries are seeing a rise in business activity while others are delaying payment of overdue invoices.

The risk of food services, transport and utility companies may be of particular concern in 2025, therefore requiring particularly close monitoring.

Mining, professional services and agriculture may continue to offer better opportunities for investment and lending, with construction also possibly eyeing a recovery.

Regional Australia winning, metro is dragging

Geographically, businesses in metropolitan Sydney, Melbourne, and Adelaide have the highest risk of business failure, currently around 7 percent higher than the national average.

This may be largely because of higher living costs and stressed budgets impacting on household consumption.

Conversely, businesses in regional Australia and in metropolitan centres, whose growth is influenced by regional and rural activity, appear to be faring better.

“For example, when compared to the national average, businesses in metro Queensland and Western Australia have 10 percent and 13 percent lower than average failure risk, while regional WA, South Australia, and Queensland have 20 percent, 15 percent, and 10 percent lower than average failure risk,” Mr Hasseldine said.

“Even businesses in regional New South Wales and Victoria are faring better than the national average.

“This lower risk is directly related to regional Australia’s relationship with the mining and agricultural sectors – these being 45 percent and 30 percent lower risk when compared to the average over all sectors.”

More promising times may lie ahead for some business sectors, and Australia might be beginning to turn the economic corner in terms of construction activity, although this is qualified optimism, as business confidence still appears to be erratic and metro services businesses still showing some signs of stress, the barometer report said.

Illion continues to monitor the situation closely each quarter.

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?