SMEs have to stop being used as a 'bank' for big business says ASBFEO report

THE Australian Small Business and Family Enterprise Ombudsman (ASBFEO) has called on the Australian Government to legislate to set a maximum payment time for big businesses to pay their small business suppliers.

The ASBFEO recently released findings from its Inquiry into Payment Times and Practices in Australia.

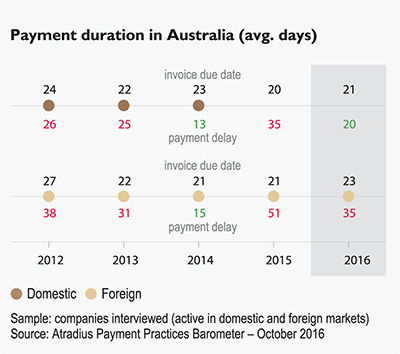

The Inquiry found widespread evidence of a growing trend for Australian and multinational companies to delay and extend payments to their suppliers with typical payment times of 30 days moving out to 45, 60, 90 or 120 days.

“Extending payment times for suppliers effectively uses the businesses in the supply chain as a cheap form of finance," ASBFEO chief executive Kate Carnell said.

“Something must be done. Small business should never have to act as a bank for big business, helping to finance multinational companies.

“This growing trend for extended payment times impacts the economy by slowing down the flow of cash through supply chains, which limits growth of businesses because they have more capital tied up in financing their operations and it raises the costs for businesses financing longer trade credit to their suppliers.

“When a business experiencing extended payment times is also hit with late payments, it stresses the business further, which can easily put them out of business. Poor cash flow is the primary reason for insolvency in Australia.”

The key recommendations of the ASBFEO Payment Times and Practices Inquiry are:

- The Australian Government to introduce legislation to set a maximum payment time for business-to-business transactions. Terms greater than this can be agreed when it is not grossly unfair

- The Australian Government to adopt a 15 business working day limit on payment terms from July 2018

- The Australian Government to introduce legislation for large business to disclose publicly all of their payment terms and performance against those terms

- The Australian Government to procure from businesses which have supply chain payment practices equal to or better than government terms.

Ms Carnell said the Australian Government needed to legislate a maximum payment time to set the standard on what was considered an appropriate upper limit on payment times for businesses operating in the Australian economy.

“Terms greater than this can be agreed by both parties to meet specific industry needs, however, where longer terms are called into dispute they may be considered to be an unfair contract term,” she said.

Ms Carnell welcomed the proposal for a voluntary industry prompt payment code although overseas experience clearly showed that voluntary measures did not compel all businesses to change their practices on extended payment terms or late payments.

She said although voluntary codes had been shown not to be entirely effective, minimum best practice would require a code to define a maximum payment time and contain a mechanism to automatically apply late payment penalties either through interest measures of other forms of compensation.

Also, minimum best practice would require regular, independent and public reporting to determine its effectiveness.

The Payment Times and Practices Final Report also recommends that the Australian Government maximise its role to set the standard on faster payment times to suppliers.

The ASBFEO recommended that the Australian Government adopt a payment term limit of 15 business working days by July 2018 to set an example for faster payments to suppliers.

Ms Carnell said the standard government payment term was 30 days and a study in the United States had demonstrated that faster payments through supply chains had increased annual payroll by $6 billion and created more than 75,000 additional jobs over three years.

She said that despite government prompt payment policies some government entities paid their suppliers late and many suppliers did not seek a late payment penalty for fear of antagonising the government entity.

The State Small Business Commissioners will also progress discussions on the Report’s recommendations with their respective governments.

An ASBFEO survey conducted as part of the inquiry found:

- Around one in two respondents reported more than 40 percent of their invoices were paid late last financial year

- Almost half of businesses have more than $20,000 owing to them from late payments and 14 percent of businesses have more than $100,000 owing

- More than half of respondents said that large/multinational businesses “always” or “frequently” make late payments. Twenty-one percent of respondents said Australian Government departments and agencies “always” or “frequently” make late payments.

Ms Carnell said that behind the economic harm done to small-to-medium businesses from late payments there were adverse impacts on mental wellbeing through stress, anxiety and impacts on families.

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?