BUSINESS experts and economists expect a rise in the number of business insolvencies, according to Australian comparison website Finder, following on from the conclusion of JobKeeper payments at the end of September.

In tthe latest Finder RBA Cash Rate Survey – the largest of its kind in Australia – 43 experts and economists weighed in on future cash rate moves and other issues related to the state of the Australian economy.

While all experts surveyed expect a cash rate hold in July (43/43), those who weighed in on insolvency (19) foresee an average of 805 businesses folding after government aid dries up in September.

Several investment and credit-reporting firms have warned that 'zombie companies' – those kept alive only by pandemic stimulus – could collapse over the next six months as stimulus measures are reduced.

According to CreditorWatch, around 550 insolvency actions were issued in April and May this year due to government stimulus relieving some pressure.

Finder insisghts manager, Graham Cooke said many more are on the way this quarter.

“At this point, it is more of a question of ‘when’ than ‘if’ many companies become insolvent," Mr Cooke said. “Referring to them as ‘zombies’ kept alive only by taxpayer money is a convenient way to remove the human component of the coming pain.

“The people affected will not be the undead, but they will be those who were trying to cross the so-called ‘bridge to the other side’ only to find that they ran out of time,” he said.

Mr Cooke noted that around 800 insolvency actions were initiated in both February and March.

“Economists aren’t predicting an enormous influx of insolvencies right away in September, but the 800 prediction is deceptive because many expect the worst to come in the months that follow,” Mr Cooke said.

Rebecca Cassells from Bankwest Curtin Economics Centre actually predicted a drop in insolvencies in September to 450, but said this is more due to scheduling than optimism in the viability of Aussie companies.

“We will likely see a spike in the number of insolvencies in October and November as supports are removed,” Ms Cassells said.

Saul Eslake of Corinna Economic Advisory, who also predicted a drop in insolvencies, said the same.

“I think banks and other creditors will hold off pursuing insolvency cases until after the debt service payment moratoria have expired (which isn't until the end of September),” Mr Eslake said.

Rich Harvey, the CEO and founder of Propertybuyer, said he expected 1,400 insolvencies in September.

“Many companies will not be able to sustain their cost base without government support and low revenue,” Mr Harvey said.

THE TRUMP FACTOR

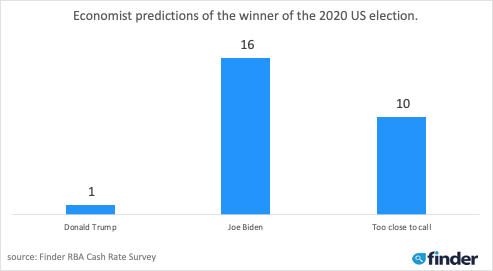

Only about 4 percent of experts surveyed by Finder predicted Donald Trump would be re-elected as US President in November.

Only one out of 27 experts who weighed in (4%) predicted a Trump victory in November.

Nearly 3three in five (59%) predicted that Joe Biden would become the 46th president of the United States, with 37 percent saying it iwas too close to call.

“The politics and attitude of the leader of the US has huge implications for the Australian economy, global trade and the value of the Aussie dollar around the world," Mr Cooke said. “With many traditional conservative voices now joining the Democrats in calling for an end to Trump’s tumultuous administration, our survey shows that Aussie economists have little faith in Trump securing re-election.

“While the initial actions from the White House resulted in a surge in the US stock market, Trump’s performance combating COVID-19 could spell the end of his presidency,” Mr Cooke said.

CASH RATE TO HOLD AT 0.25%

With the short-term economic future very uncertain, most economists are also sure that the RBA cash rate would go no lower than its current 0.25 percent.

Two-thirds of experts (28, 66%) said they eventually expect the rate to increase, but only one, Tony Makin of Griffith University, expected a rise this year.

“If the virus is satisfactorily contained, and assuming no second wave, the economy should be recovering by the December quarter," Mr Makin said.

“In the context of a domestic and global recovery, the high money growth stemming from public debt monetisation should put upward pressure on the price level, necessitating a monetary policy response.

“Additionally, the huge issues of government bonds to fund large pandemic-related budget deficits that have not been monetised by central banks here and worldwide, would normally put upward pressure on longer term world interest rates,” Mr Makin said.

COMMENTS BY THE EXPERTS:

Nicholas Frappell, ABC Bullion: "The RBA have indicated that they will keep the rates low for a long period. At the moment it's too early to have a view of when the rates will tighten again, although 'sometime' in 2022 would be reasonable..."

Shane Oliver, AMP Capital: "The RBA will remain on hold. There is little to no value in taking rates to zero or negative and given the recession, high unemployment, uncertainty about the recovery and inflation running way below target, it's way too early to think about raising rates. In fact, it's unlikely to be able to raise rates for the next three years at least."

Alison Booth, ANU: "Hard to pinpoint when there might be changes, since there's so much uncertainty and the RBA will be making decisions as necessary to keep borrowing costs low and credit available."

John Hewson, ANU: "[These are the] worst economic circumstances since Great Depression."

Malcolm Wood, Baillieu: "RBA on hold until back close to full employment and underlying inflation sustainably in the 2-3% YoY band."

Rebecca Cassells, Bankwest Curtin Economics Centre: "Any decision by the RBA to either increase or lower the cash rate is highly unlikely for some time and we can expect the cash rate to remain exactly where it is now for at least the next two years. The most likely direction the cash rate will head eventually is upwards, but we will need some fairly solid and consistent signs of recovery in the labour market before the RBA starts to consider this change. Towards the fourth quarter of 2021 we should be well on our way to more positive signals here, but much will depend on the level of government support and stimulus committed to jumpstart the economy and our ability to minimise and prevent COVID-19 outbreaks. Both are very uncertain right now."

David Robertson, Bendigo and Adelaide Bank: "The RBA have very clearly flagged that rates will be on hold at 0.25 percent (for both official cash and the three-year bond) until well into 2022. The next move beyond there should be up when inflation finally rises and labour markets tighten."

Sarah Hunter, BIS Oxford Economics: "The RBA have made it clear that, for now at least, they don't see negative rates as being necessary or effective. So I think the next move will be up, but it will be quite some time into the future – beyond the end of the forecast horizon in the survey (Q4 2022)."

Ben Udy, Capital Economics: "We suspect the RBA will come around to our view that inflation will be below the bank's target for years and therefore launch more stimulus. We expect the RBA to eventually expand quantitative easing with a quantity bond target aimed at the longer-dated end of the yield curve."

Peter Boehm, CLSA Premium: "Now is not the time to move interest rates – there's too much economic uncertainty, and clarity around the Federal Government's existing and future planned response to COVID-19 is needed before further rate movements should be contemplated."

Saul Eslake, Corinna Economic Advisory: "Could be that the RBA keeps rates on hold until after Q4 2022."

Craig Emerson, Craig Emerson Economics: "The RBA Governor has publicly stated that the cash rate will remain where it is for a long time."

Trent Wiltshire, Domain: "The RBA won't be increasing the cash rate until the unemployment rate is near 5 percent, which is unfortunately at least a couple of years away."

John Rolfe, Elders Home Loans: "I do not believe the RBA will entertain a zero or negative cash rate. The banking industry is not in need of lower rates and even if provided, there will not be any rate reduction passed on to the customer. There are still QE opportunities to stimulate the market if needed."

Angela Jackson, Equity Economics: "There is significant uncertainty around the timing of a vaccine for COVID-19 which impacts the point at which the Australian and global economy will start to recover."

Mark Brimble, Griffith Uni: "The economy will need monetary policy support for a long time to come."

Tony Makin, Griffith University: "If the virus is satisfactorily contained, and assuming no second wave, the economy should be recovering by the December quarter. In the context of a domestic and global recovery, the high money growth stemming from public debt monetisation should put upward pressure on the price level, necessitating a monetary policy response. Additionally, the huge issues of government bonds to fund large pandemic-related budget deficits that have not been monetised by central banks here and worldwide would normally put upward pressure on longer term world interest rates."

Stephen Miller, GSFM: "The headwinds to growth are strong and I do not think that inflation will be comfortably within the current 2-3 percent target range until the end of 2022. I do not think the RBA will lower rates. If they wish to ease further they will employ some other mechanism."

Alex Joiner, IFM Investors: "The RBA is going to have its current policy settings in place for an extended period of time as it needs to support the economy while the labour market repairs. It is difficult to envisage a rise in the cash rate before the end of 2022 in my view as not only do unconventional policies need to be unwound first, it is abundantly clear the RBA won't want to be ahead of other central banks in removing their huge stimulus programs and therefore putting undue upward pressure on the AUD."

Leanne Pilkington, Laing+Simmons: "We have years of low interest rates ahead of us and the banks themselves have sharpened their pencils in recent times, cutting their rates on various products to remain competitive. The pandemic continues to cast a shadow over the economy and the outlook is meagre, but for those whose income remains secure, a real estate purchase is comparatively affordable at present."

Nicholas Gruen, Lateral Economics: "It will be a long road back, especially as the government appears to be keen to reduce the extent of the stimulus."

Mathew Tiller, LJ Hooker: "It's unlikely that the RBA will drop rates further and is expected to continue to support the economy via other stimulatory measures until the full impact of the COVID crisis passes."

Geoffrey Harold Kingston, Macquarie University: "Current monetary and fiscal policies, along with abatement of the virus, will see a gradual emergence of inflationary pressures."

Jeffrey Sheen, Macquarie University: "Consistent with signalling from RBA."

Stephen Koukoulas, Market Economics: "The post COVID-19 recovery will be in place and inflation will edge up toward the RBA’s target."

John Caelli, ME Bank: "The RBA have indicated they will keep rates where they are for a long time."

Michael Yardney, Metropole Properties: "The RBA have indicated it will not raise interest rates until unemployment levels fall to around 4.5 percent. This is many years away."

Mark Crosby, Monash University: "I don't think that further moves in the cash rate would be effective, and given uncertainty around COVID, the timing of future moves is highly uncertain, but doubtful rates will move before 2022."

Julia Newbould, Money Magazine: "I think that the government will need to see what happens when the stimulus payments end and the economy finds its new position."

Susan Mitchell, Mortgage Choice: "I expect the cash rate to remain unchanged at the Reserve Bank’s next monetary policy meeting until progress is made towards the RBA’s goal of full employment and the inflation target. The historic low cash rate continues to support an extremely low cost of borrowing and we are seeing a surge in the number of borrowers choosing to refinance and lock in a fixed interest rate."

Dr Andrew Wilson, My Housing Market: "Monetary policy will continue to be sidelined over the foreseeable future with no logical purpose served by a further cut to zero percent and the prospect of a rise fanciful given economic conditions set to worsen."

Jonathan Chancellor, Property Observer: "Despite their signalling that rates will not be lowered, I think circumstances will warrant the decision to take rates to zero."

Rich Harvey, Propertybuyer: "Far too much volatility and uncertainty to see any movements in interest rates at the moment."

Noel Whittaker, QUT: "This is so difficult – there are so many uncertainties. But, of course, if a vaccine is found the economy may boom."

Cameron Kusher, REA Group: "As much as the RBA is insistent that the current cash rate of 0.25 percent is their floor, depending on the recovery from COVID-19 it may necessitate taking rates lower. Remember that just last year they were saying they didn't believe in QE's effectiveness. Even if they don't cut interest rates further, a hike in interest rates seems likely to be a long way off."

Jason Azzopardi, Resimac: "Clear guidance given by RBA the current monetary policy will remain."

Christine Williams, Smarter Property Investing: "Unstable economy at the moment."

Janu Chan, St George Bank: "RBA will keep its accommodative stance for some time while unemployment remains high. Indeed, the risk is towards additional monetary stimulus measures but the RBA will look to other measures. The cash rate is as low as it can go."

Besa Deda, St George Bank: "The RBA has provided forward guidance about its use of unconventional policies in several speeches since March. During questions following one of these speeches, Governor Philip Lowe has indicated that the cash rate will not be lifted before the three-year bond yield target has been lifted. In addition, he said that the bond yield target will not be removed until progress was being made towards the RBA's inflation and unemployment targets. This is estimated to be at least three years away."

Brian Parker, Sunsuper: "A rate hike is beyond the survey's time horizon."

Mala Raghavan, University of Tasmania: "It is difficult to predict now due to the high uncertainty surrounding the COVID-19 crisis and the subsequent economic crisis. The focus of the policymakers at this stage should be stimulating the economy, but there is not much room in the monetary policy space for that. At this stage, the government's fiscal stimulus is much needed to spur the economy."

Other participants: Duncan Macfarlane, Firstmac. John Smith, Economist.

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?