Government brings in the Telecommunications (Interception And Access) Amendment (Data Retention) Act 2015, but some ISPs floundering

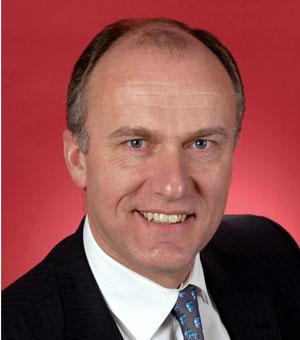

THE Australian Attorney-General, George Brandis, has welcomed the commencement of the Telecommunications (Interception and Access) Amendment (Data Retention) Act 2015 on October 13 and announced grants to assist compliance.

As many smaller internet service providers (ISPs) are struggling to meet their obligations under the Act, extensions for compliance out to April 2017 have been built in, along with a grants program, according to the Attorney-General.

"Metadata is the basic building block in nearly every counter-terrorism, counter-espionage and organised and major crime investigation," Senator Brandis said.

"It is also essential for the investigation of child abuse and child pornography offences, that are frequently carried out online, and other forms of organised crime.

"With the expiry of the initial six month implementation period, telecommunications companies can apply for an extension of up to 18 months (April 2017) to comply with the legislation," Senator Brandis said.

"The government continues to work constructively with the industry to achieve full compliance by April 2017.

"Over $131 million has been committed by the Government to contribute to the upfront capital costs of the scheme.

"Telecommunications companies have always retained metadata and law enforcement agencies have been permitted access to these records for decades, however industry practices have varied. The new scheme implements a uniform standard.

"The Data Retention Act standardises the timeframe and type of data held giving law enforcement and national security agencies consistent information of the kind they need to keep the community safe," Senator Brandis said.

The Act also introduced new and strengthened safeguard arrangements, in particular by significantly reducing the number of agencies that can access metadata.

The Attorney-General's Department is finalising details of a grants program and it is expected that payments will be made early next year, well before April 2017, Senator Brandis said.

"The government will continue to work closely with industry; the focus will be on implementation rather than enforcement," he said.

www.attorneygeneral.gov.au

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?

That is the warning from lawyers Cooper Grace Ward, who have found that businesses non compliant with the Australian Privacy Principles could now face major penalties.

That is the warning from lawyers Cooper Grace Ward, who have found that businesses non compliant with the Australian Privacy Principles could now face major penalties.