New home lending continues its downward trend - HIA

THE SUPPLY of new homes is set to continue to decline under the weight of rising interest rates, according to Housing Industry Association (HIA) senior economist, Tom Devitt.

The ABS released the Lending to Households and Businesses data for April 2023 on Friday of last week.

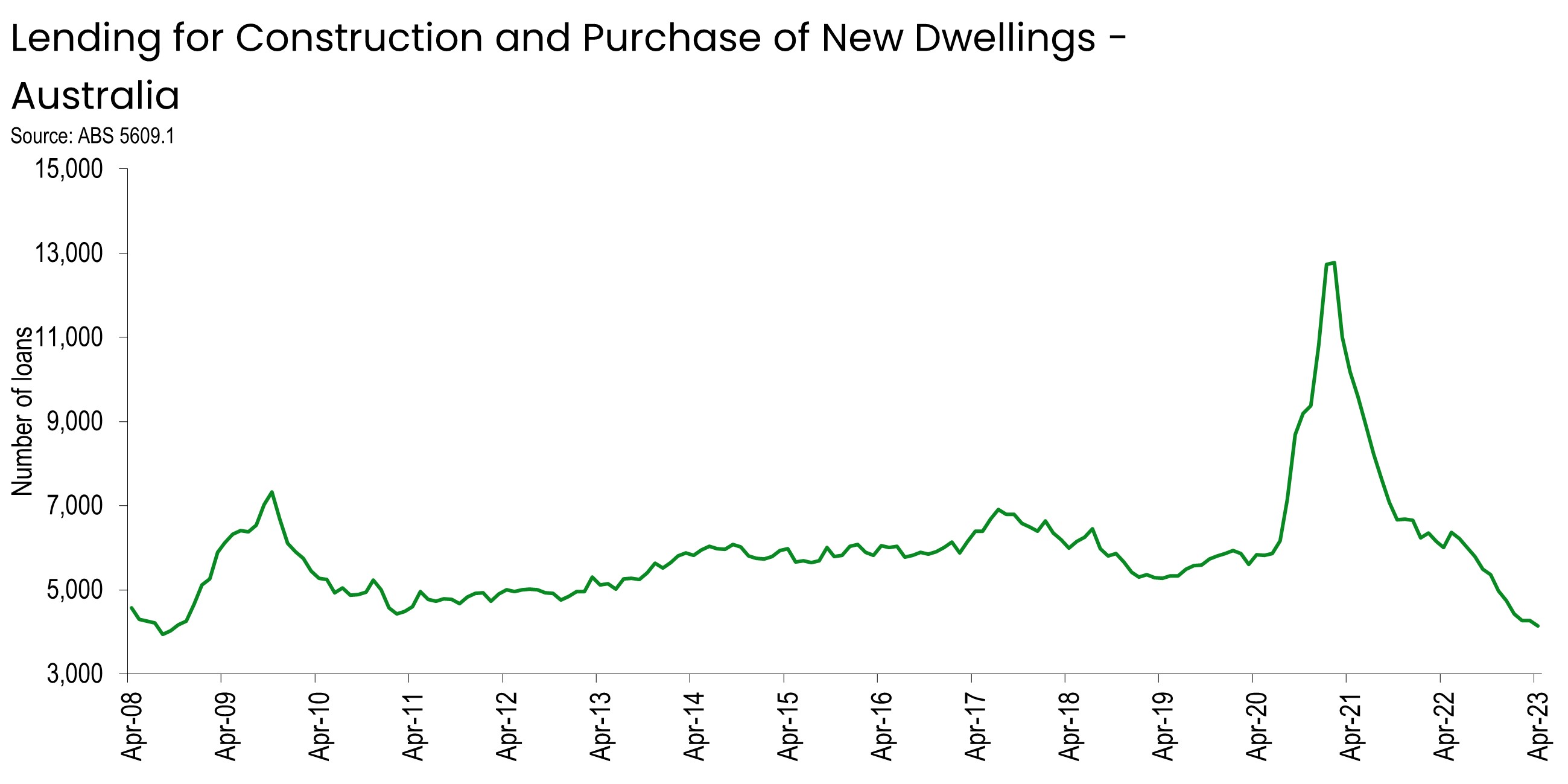

“The number of loans issued for the purchase or construction of a new home has fallen to a new low,” Mr Devitt said.

“The last time so few loans were issued for the purchase or construction of a new home was in September 2008, when the GFC caused a contraction in building.

“Lending for the purchase and construction of new homes in the three months to April 2023 was 31.5 percent lower than at the same time last year.

“There are very long lags in this cycle and the full impact of the RBA’s rate increases are still to fully hit the housing market, let alone the broader economy," he said.

“These low lending numbers reflect a lack of new work entering the pipeline at the same time that population growth is surging.

“There needs to be a structural increase in the number of homes being built across Australia, a fact recently acknowledged by the RBA.” Mr Devitt said.

In original terms, the total number of loans for the purchase of construction of new homes in the three months to April 2023 declined in all jurisdictions compared with the same quarter a year earlier, led by the Australian Capital Territory (-67.5 percent), and followed by New South Wales (-34.9 percent), South Australia (-32.1 percent), Tasmania (-31.6 percent), Western Australia (-31.3 percent), Victoria (-29.5 percent), Queensland (-27.4 percent) and the Northern Territory (-5.1 percent).

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?