Medical research fund widens the goal posts

EXTRA >>

THE Medical Research Commercialisation Fund’s (MRCF) current third round of capital raising has not just shifted the goal posts for biotech innovation in Australia, it has widened them substantially. It is a paradigm shift according to MRCF chief executive, Chris Nave.

It is still possible to miss, according to Dr Nave – and it is his job to “try to make these companies fail” because the ones that make it are likely to be big winners – but now innovative Australian biotech start-ups have a much greater chance of scoring. And scoring big, internationally.

That’s because, for the first time, Australia’s superannuation industry is properly engaged with the fund to provide substantial financial backing to the biotech innovation sector.

In the past, Dr Nave said, the $3 trillion Australian superannuation industry did not consider the sector a safe-enough option for superannuation investment. However, the involvement and support of most Australian state governments over recent years, matched with some major success stories and financial returns from start-ups fostered by the MRCF program, has changed everything.

“We realised in the medical research sector that if we had a cardiologist or a clinician like Daniel (Timms) with a great idea (the complete artificial heart, BiVACOR), we had no ability to support the funding even to get the patents, let alone take it from the laboratory through to a development stage that either a pharmaceutical partner would come in to support it, or whether a traditional investor would come and support it,” Dr Nave said. “So what happened was a lot of our IP was being lost.

“The MRCF was set up to try and fill that funding gap. We went to a bund of research institutes and said, we want you to join a venture fund. If you join the fund, I’ll be able to raise the money. But if you join you have got to give us first right to review your opportunities.

“I went to the super funds and said I’m going to get some great institutes to join, if you give us money, they’ll give us first right to look at their opportunities.”

“We don’t just invest. We help establish these companies, we help put management teams around them … often we are the management team for the first two or three years while we are doing crucial experiments.

“We basically have every major medical research institute and every department of health in Australia as a member now,” Dr Nave said. “The most powerful thing is that we bring every one of these organisations together every six or seven weeks. They send a representative to that meeting.

“It probably sounds like an unwieldy meeting, but it functions incredibly well. It is the only initiative in Australia that brings together all of the clinical and medical research capability on a regular basis,” Dr Nave said.

“Normally, as we know, everyone is in their silos, busily researching away a applying for grants and competing for grants. This initiative helps us to look at all the capability in Australia and help create collaborations.”

Dr Nave said the benefit of this MRCF model is that the research partners get access to dedicated funding “so we overcome that early stage funding gap”.

“For the investors, they get first right of review of the opportunities, so they realise that there is real risk here, but they hope that they get the next Spinifex or the next Cochlear,” he said. “They are prepared for failure, to make sure they are at the table when they get that success.

“We have had strong returns from drug companies. Fibretech we sold late last year to Shire. It was a $552 million deal. That result represented a 62-times result for our total investment. So it was a really significant deal. When we talk about risk versus reward, this industry really pays off.

“Spinifex we sold a few months ago – I was on the board and I was the Australian rep on the transaction committee – and it was a huge exit, significant – it was A$998 million, the total deal. This is a Queensland-based technology, developed by a really smart researcher, but it started as an idea in a laboratory. It just shows we can do it.”

PARADIGM SHIFT

This approach changes fundamentally the way biotech can be developed in Australia and could help to set the country up as a world leader that consistently develops and commercialises breakthroughs.

“Funding for early stage opportunities really just doesn’t exist in Australia,” Dr Nave said

“It was either being licensed at sub-optimal terms to international companies or it just wasn’t being developed. They (university researchers) were publishing it and then moving on to the next thing. “Remember, this is taxpayer funded research. It should be an obligation for us to make sure we actually generate income and jobs out of the outcomes of that taxpayer funded research.

“As you can imagine, going to sandstone institutes telling them join a venture fund, that’s a bit of an anathema. And so I had great difficulty in the early days. I managed to get seven institutes to join in the early days and then got support from two state governments,” he said.

“Pretty quickly, within six months, word got out that we were actually doing what we said we’d do. We were helping them identify opportunities and we would help them package IP. Then we were hopping on the other side of the fence and investing.”

Dr Nave said the ongoing support of state governments had been crucial to progress.

“State governments have supported us through two election cycles and have all just committed to another seven years – they get funding that actually supports the infrastructure that they have been investing in and developing,” Dr Nave said. “Obviously, hopefully, we help to grow a sustainable industry.

“The MRCF has performed very well, we have been fortunate.

“We have 20 active companies and they cover all of the spectrum that you would expect in biotech – drugs, devices, delivery platforms and diagnostics. We have a number of Queensland companies.”

Dr Nave said the MRCF had success in the development, too, of device companies.

“Osprey we listed in June 2012,” he said. “It was the only company in the world in the biotech space that stayed above its list price. We have just completed a large 650 patient US study and the FDA have approved expanding claims. We have a focus launch at the moment in Texas and sales have doubled every quarter for the last four quarters. We actually have two term sheets on the table now with global pharmaceutical companies.

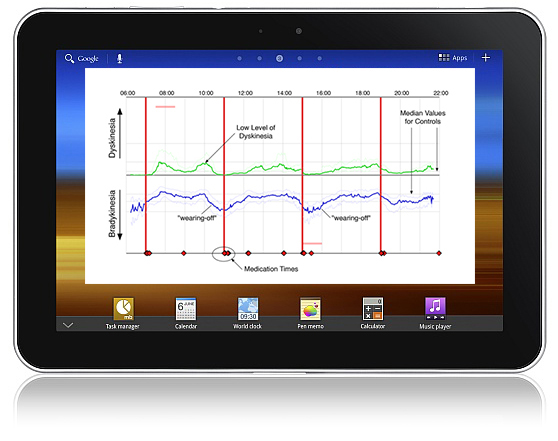

“GKC (Global Kinetics Corporation) is another story out of Florey (Neuroscience) Institute,” Dr Nave said. “This is a device for treating Parkinson’s disease. It is now being sold in 115 sites across 11 countries and growing rapidly and we have the major companies around the world all funding the roll-out of this product because it makes such a difference to their products that they co-sell with it.

“Again, a device being manufactured here in Australia, with a market size that is actually bigger than Cochlear’s.”

But Dr Nave said the fund had also had its share of failures – but that went with the territory and it was something “we need to get better at embracing in Australia”.

“Failures have been very interesting for us,” Dr Nave said. “Our investors now feel really comfortable when we kill something, as they see it as investment discipline. Every time something fails we get better at that and we learn for what we do next.

“I often say my job is actually to just try to kill things quickly. The things that I can’t kill go on to be successes.

“As an industry and as a country we need to get better and more comfortable with failure. CEOs of these companies often have a black mark against them for two years before that is washed off and they get the next job.

“That’s crazy. We want people who have seen the movie before and know what it takes to be successful.

“What has surprised us is that because the MRCF is prepared to work with the organisations from the very beginning, sort out IP, write business plans, and then invest, we have actually attracted a lot of other capital that wouldn’t ordinarily come.

“For every dollar we have put in we have attracted another $7 of capital put in – and that’s cash. That’s not in-kind. That’s pure cash going back into the sector. That is a very significant modifier and a very big part, I think, of why state governments keep supporting us.”

The figures verified Dr Nave’s view that MCRF was a true paradigm shift for Australian biotechnology.

“Our first fund we returned over double the money and we have still got seven companies in that portfolio,” he said. “In the second fund we have returned all the fund and that one still has 13 companies left. Our funds have performed well. We have returned over 33 percent RoI over the last three years.

“We went back to our investors and said we took money the way you wanted us to, but we thinks we can push harder and so put to them a concept of splitting what we do into two parts.

“Part A is a $200m fund which is now closed in investing. Stage one of that we have set aside $50m to support 25-35 opportunities. So that is seeding heaps of stuff.

“We’d expect a lot of those to fail, but the important thing is that we get them out and we see if they’ve got a chance of success,” Dr Nave said.

“The companies that are successful go on to stage two, where we have $150 million and we can put up to $17 million per investment. For some of our drug companies this will take them through to phase two proof of concept and we will be able to exit like we did with Spinifex and with Fibretec.

“But the real paradigm shift has been that we now have a stage three for our device companies. We can now put up to $20-$30 million per investor, so up to $120 million per company into assets that truly have the chance to be global businesses.

“This is the paradigm shift because we have not had this capability in Australia – we have always been beholden to sell them at a certain stage overseas, or run the public markets path.

“Our investors are saying please give us real businesses that grow up and our crossover funds will then invest, and our super funds, our public markets funds will still invest and it will help your system and give us greater diversity,” Dr Nave said.

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?