Nimble rapidly rewrites the rulebook on rapid loan services

FEW financial services businesses can claim to understand their customers like Nimble does. As an organiser of small, rapid loans, Nimble’s technology is meeting the immediate needs of Australians just like Greg Ellis and Sean Teahan – the founders of the business who know what it is like to manage everyday financial challenges.

Lately Nimble has been recognised through a range of awards – including a Platinum Australian Customer Service Award, BRW Fast 100 and Telstra Australian Business Award – for the sophistication of its financial technology platform, which assesses loan applications in seconds by analysing thousands of data points.

However, the company’s essence and real point of difference, is that it has never forgotten that no matter how good the technology, tech businesses are fundamentally people businesses.

“The company’s founders, Greg Ellis and Sean Teahan, struggled to make ends meet in the early days, sometimes resorting to mowing lawns to keep the lights on,” said Nimble chief operating officer, Sami Malia.

“This humble beginning has instilled in this businesses an absolute dedication to respecting the individual needs of our customers, and just as importantly, our team members.”

Mr Malia said in some quarters the term ‘corporate culture’ has become a glib throwaway line used by recruiters and spin doctors.

“In fast-growth start ups, culture is the fundamental glue that keeps a team and a company moving towards a common goal,” Mr Malia said.

He believed Nimble’s success was accelerating because of its no-nonsense, open culture and the way it used technology to meet the needs of its market almost instantaneously.

During the past 12 months Nimble has doubled the number of new members, increased the number of loans by 71 perent and grown the team by over 50 perent to 130 employees.

At the same time the Net Promoter Score (NPS) – the key indicator of customer satisfaction in the financial services sector used by Nimble – is as an industry high.

Mr Malia said the average NPS of the big four banks was minus15.5 percent, credit unions plus 28.6 percent and Nimble is plus 56 percent.

“This excellence in customer service has been achieved by building a culture that strategically places customer service first and foremost,” Mr Malia said. “Customer satisfaction is linked directly to employee KPIs, internal messaging and a clear mission statement.

“We’re proud that our members come from all walks of life, professions and salary levels and that every one of them is treated with respect,” he said.

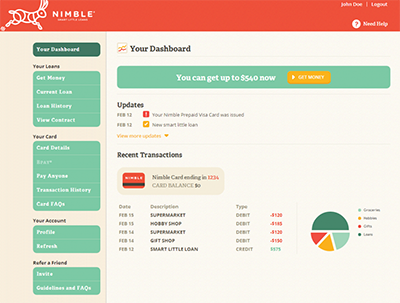

Nimble lends between $100 and $1200, with the application process completely online. In most cases an approved loan will be in the member’s account within 60 minutes.

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?