Cash flow greatest problem for Aust. businesses

NEARLY 24 percent of the 200 Australian suppliers surveyed in the latest Artradius Payment Practices Barometer find cash flow to be the greatest challenge to business profitability in 2016.

“Commodity-rich countries like Australia will face headwinds in 2016 and 2017 following the decline in commodity prices,” Australia and New Zealand managing director for credit insurance provider Artradius, Mark Hoppe said.

“While Australia is making an effort to diversify its economy, aided by its depreciating currency and the loosening monetary policy, bankruptcies for 2016 are forecast to increase by eight percent.

“Due to the vulnerability of its economy to low commodity prices, many Australian businesses have a strong focus on trade receivables management, and on protecting their cash flow and profitability against the risk of payment default arising from B2B trade on credit.”

According to the Payment Practices Barometer, 84 percent of respondents reported late payment of invoices by domestic and foreign B2B customer over the past year.

On average, half of the total value of B2B receivables remained unpaid after the due date, mostly arising from foreign trade.

The barometer also showed that Australia had the highest foreign default rate among Asia Pacific countries surveyed.

Based on responses given by Australian suppliers, a significantly larger proportion of the total value of B2B receivables arising from foreign trade (57.6 percent) than from domestic B2B trade (40.3 percent) remained unpaid after the due date.

“Besides highlighting that Australian suppliers are the most impacted by foreign late payment among the Asia Pacific countries surveyed, this finding suggests they manage domestic trade receivables better than foreign ones,” Mr Hoppe said.

“This may be the reason why more suppliers in Australia (nearly 24 percent) than in Asia Pacific (nearly 20 percent) consider maintaining adequate cash flow to be the biggest challenge to profitability this year.”

This is also likely to reflect Australian suppliers’ concerns about the impact that lower demand from China could have on their businesses.

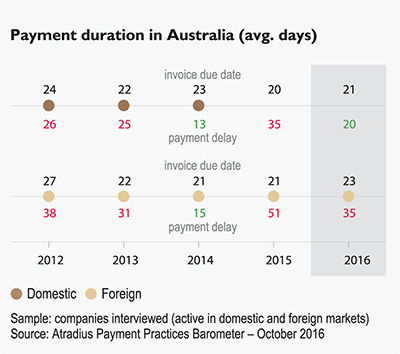

Australian suppliers request both domestic and foreign B2B customers to pay invoices, on average, within three weeks of the invoice date. This is well below the 32 days average for Asia Pacific and the shortest observed for the countries surveyed in the region.

This may reflect an attempt by Australian businesses to counter a potential worsening of their liquidity position, due to an expected upswing in days sales outstanding, with short terms for payment of invoices.

Although nearly 30 percent of the suppliers surveyed in Australia (below the 34 percent regional average) reported that foreign B2B customers pay invoices late due to liquidity issues, foreign late payment appears to be most often attributable to reasons that are unrelated to the liquidity position of the customers.

These include the complexity of the payment procedure, inefficiencies of the banking system, and intentional slow payment as a form of business financing. each reason was cited by 25 percent of Australian suppliers.

Mr Hoppe said, “Intentionally waiting until the last minute to pay invoices as a form of business financing appears to be more common among Australian businesses compared to their regional counterparts. This could reflect Australian businesses’ concerns regarding cash flow and the desire to hold onto cash for as long as possible.

“Organisations looking to protect their cash flow and to offset the negative impact of being paid late should consider trade credit insurance. This can make up the shortfall when customers can’t or won’t pay, and lets businesses trade with confidence even in difficult times.”

ends